flow through entity tax break

Rather than paying a separate tax on the business investors pay tax on their income and this covers the business entity. If a reduced rate of withholding under an income tax treaty is claimed the claimant must be able to treat as a flow-through entity any entity between you and the claimant.

Pass Through Taxation What Small Business Owners Need To Know

To C or not to Cthat is the question for many business ownerswhether tis nobler to organize as a flow-through entity with future planning flexibility or convert to a C corporation with a better tax rate.

. The decision may be tougher than first thought according to Jim Biehl a CPA and shareholder at Clayton. Individuals with taxable income in the 24 bracket may have their flow-through income taxed at 192 24 20 192 for a savings of only 48. Because your business pays its taxes through your individual tax return it is known as a pass-through entity.

The majority of businesses are pass-through. In an item posted to its website legal firm Varnum LLP explained that taxpayers who are shareholders or members of pass-through entities or certain trusts can elect to calculate and pay Michigan income tax at the entity level. There is no double taxation in a flow-through entity no separate tax is levied on the income of the entity and the income of the owners.

A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Ordinary income up to the maximum 396 percent rate.

Flow-through businesses include sole proprietorships partnerships and S. The determination of whether an entity is fiscally transparent is made on an item of income basis that is the determination is made separately for interest dividends royalties etc. Often the owners of a corporation must take a distribution in order to pay their corporations taxes.

To the extent that the ERP increases as shareholder-level taxes increase reducing the expected net cash flow stream by some imputed entity-level tax rate benefit for the presumed advantage of partnership tax status may result in an overstatement of value. The Tax Adviser is the AICPAs monthly journal of tax planning trends and techniques. ADVANTAGES OF FLOW-THROUGH ENTITIES Flow-through businesses generally face the same tax rules as C corporations for inventory accounting depreciation and other provisions affecting the measurement of.

In the end the purpose of flow-through entities is the same as that of the other business entities. Effective January 1 2021 the Michigan flow-through entity FTE tax is levied on certain electing entities with business activity in Michigan. This amount generally correlates to the business income attributed to members who will.

The benefits and tax obligations of operating flow-through entities and pass-through businesses are more complex than ever. The tax rate at the entity level the Varnum article explained is 425 the same as the individual income tax rate. This requires many business owners and members of flow-through partnerships to expend more effort to understand.

Is elected and levied on the Michigan portion of the positive business income tax base of a flow-through entity. Alan Wong is a senior managertax with Baker Tilly Virchow Krause LLP in New York City. Wong at 212-792-4986 ext.

It offered a permanent reduction in tax rates for corporations to a top rate of 21 from 35. The purpose of flow-through tax forms is to attach income to a tax-paying entity namely you. Common Types of Pass-Through Entities.

AICPA members can subscribe to The Tax Adviser for a discounted price of 85 per year. Also losses accrued by the entity can be used. When an investor is looking to purchase a flow-through entity they are doing so because they believe that they can receive a.

For additional information about these items contact Mr. Virtually all states recognize traditional general partnerships and limited partnerships as flow through entities for taxation purposes. Flow-through businesses include sole proprietorships partnerships and S corporations.

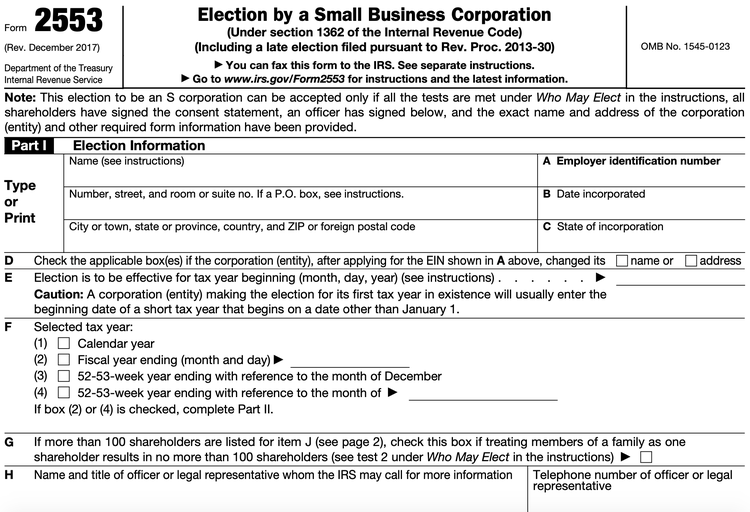

This is done via the Schedule K-1 on Form 1120S. The Standard of Value. We believe that deferred taxes related to an investment in a foreign or domestic partnership and other flow-through entities that are taxed as partnerships such as multi-member LLCs should be based on the difference between the financial statement amount of the investment and its tax basis ie its outside basis difference.

Tax Section members can subscribe for a discounted price of 30 per year. However the late filing of 2021 FTE returns will be accepted as timely if filed within 6 months of the due date. How Does a Flow-Through Tax Entity or Pass-through Entity Work.

The main issues here are not so much status issues but the applications of taxation to the model of a flow through entity. Meanwhile President Joe Biden is unveiling his. Flow-through entities are used for several reasons including tax advantages.

The main difference between the two entities is the tax advantages. Unless otherwise noted contributors are members of or associated with Baker Tilly Virchow Krause LLP. With an election in place and.

Regulations continue to change the thresholds and treatment of both revenue and expenses for many organizations. Effective January 1 2021 the Michigan flow-through entity FTE tax is levied on certain electing entities with business activity in Michigan.

Elective Pass Through Entity Tax Wolters Kluwer

Benefits Of Incorporating Business Law Small Business Deductions Business

What The New Tax Bill Means For Small Business Owners Freelancers Business Tax Deductions Accounting Finance Business Major

California Enacts Changes To Elective Pass Through Entity Tax Hcvt State Local Tax Holthouse Carlin Van Trigt Llp

Pass Through Entity Tax 101 Baker Tilly

Infographic Corporation Vs Llc Accounting Classes Business Entrepreneurship Class

Formation Of Business Entities Law Chart The Letters C And S Represent Chapters In The Irs Tax Code C Law School Life Business Law Law School Prep

How To Get Paid As An Owner Of A Pass Through Entity How To Advice For Your Side Hustle Or Small Business Filing Taxes Tax Time Tax App

Pass Through Entity Definition Examples Advantages Disadvantages

Welcome To Black Ink Tax Accounting Services We Hope To Provide You With Timely And Valuabl Accounting Services Tax Preparation Services Offer In Compromise

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

Flow Through Entity Overview Types Advantages

What Is Input Tax Credit Or Itc Under Gst Exceldatapro Cash Flow Statement Accounting Tax Deductions

What Are The Benefits Advantages Of Cash Flow Statement Cash Flow Statement Cash Flow Cash Management

A Beginner S Guide To Pass Through Entities

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Pass Through Entity Definition Examples Advantages Disadvantages